Utilizing an all-in-one ETF on your RRSP

Charge on the small account are another factor to look at before you could wade Diy. Bank-had brokerages often charges $a hundred a year for the RRSPs one to don’t satisfy their lowest membership dimensions standards—usually $15,000 or $twenty five,100, with regards to the broker. Certain may charge higher trade income in case your harmony is actually lower than a particular tolerance.

— Jim imagine a costly fitness center subscription will help motivate your so you can prevent being an inactive since most of one’s gym equipment is actually associated with tvs. Would you guess the meaning of one’s couch potato idiom simply because of the studying the photo? A couch potato are a famous term within the Western English very it’s really worth discovering. Know about the fresh requirements we used to assess slot game, with from RTPs to help you jackpots.

Note that these design portfolios were a number of objectives to possess carries and you will bonds. Conventional traders is always to allocate a greater to talk about so you can ties (that are much safer) much less so you can carries. Competitive people usually takes far more exposure because of the allocating a higher proportion to help you brings. Most investors was well-prepared by a well-balanced portfolio away from somewhere between 31% and 80% carries.

- If you are here’s zero ensure associated with the inverse relationships, it’s generally acknowledged you to definitely carrying brings and you can bonds together with her makes a good lower-chance collection.

- The online game was created such a means so it seems because the full bundle, since the history bluish functions as a contrast facing all loving colors that are put on display screen.

- Canadian Couch potato can make plenty of higher suggestions for people that are looking to manage their particular investments.

- We’re not gonna generate a visit to the interest rates to the an initial-term basis, however, because of the listing lower prices, they really just have one destination to go, that is up.

- In such instances, somebody will get say things such as “he’s already been a passive for too long”, showing that they need to awake and begin getting around far more.

For individuals who’re also paying $10 any time you purchase otherwise offer an enthusiastic ETF, you should wait until you have at the very least $2,000 or so before you make a purchase. Let’s start with approaching the fear of shedding the capability to decide which ETFs to offer to cover the typical distributions. For individuals who keep numerous money, it’s true, you can mix their detachment bundle together with your rebalancing means. Such, if you want to withdraw $25,000 from the RRSP, you ought to find out and therefore investment category try extremely heavy in the portfolio, and thin you to carrying. For many who’re also heavy stocks, then you definitely will be promote particular carries to help you provide the fresh $twenty five,one hundred thousand.

RSSY ETF Opinion – Go back Stacked U.S. Carries & Futures Give ETF

Those individuals subscribers just who enjoyed the very thought of including loyal inflation-fighting property were compensated. I ought to keep in mind that the newest inflation-fighting assets—including commodities, gold and product holds—might not be necessary while you are on the buildup stage, meaning your’re also accumulating their portfolio. Over-long periods out of 15, twenty years or even more, stock locations have made a stunning rising cost of living hedge. In the later years, otherwise even as we strategy the new retirement risk zone, avoiding close-name rising prices risks is very important. Second, let’s go through the performance of one’s advanced couch potato profiles during the certain risk membership.

Take action dos: Character Play

When Browne developed the Permanent Profile regarding the mid-eighties, they wasn’t including easy to do on your own. Browne advised isolating your finances equally certainly carries, long-label government ties, silver and money. Many of these ETF profiles below were Canadian holds, United source weblink states stocks, and global stocks (out of each other set up and you can growing areas), giving you greater contact with the global guarantee market. He could be well-balanced by the an allowance to ties to minimize volatility and you can exposure. Choosing the compatible mixture of carries and you can securities is considered the most important choice you’ll want to make. My personal colleagues Justin Bender and you may Shannon Bender have created a great video so you can get this important options.

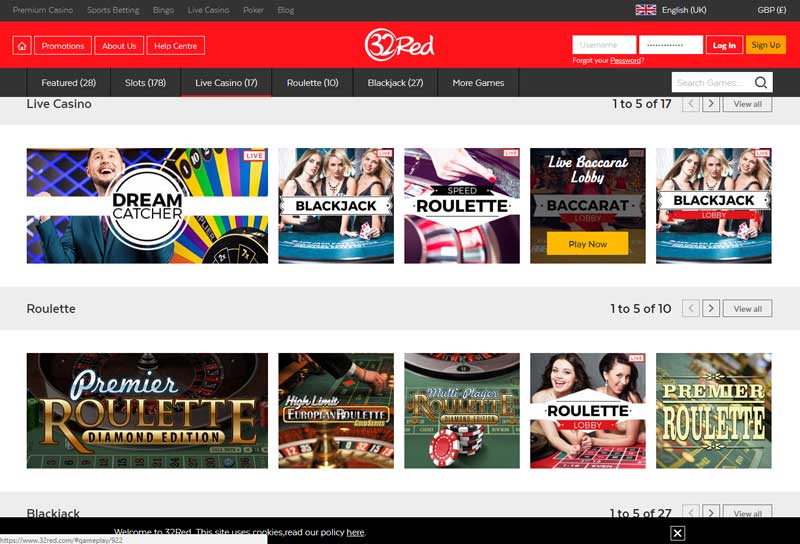

Seeking to build your individual Couch potato collection that have index finance or ETFs? Ultimately, understand that vocabulary evolves over the years and you can significance can transform. If you are “inactive” has been in existence for a few ages now, their utilize can get change because the public thinking for the free time and you can productivity always evolve. Inside pairs, get transforms acting out scenarios where someone is being a good “couch potato” plus the most other is trying in order to inspire these to wake up and you may do something energetic. If the an online casino seems to push a down load you, it’s doubtful.

This era takes into account inception time to your ETF property readily available. And also the start time coincides on the start of inflation anxieties during the early 2021. The newest Vanguard portfolio is the laggard, since the all of the-industry ETF it’s ten% exposure to growing locations.

The take a look at is the fact that this online video slot doesn’t provide nearly sufficient spins incentives to help you warrant a location for the one user’s listing of favorites. While you are you will discover particular professionals which will discover the brand new free revolves incentives becoming slightly valuable, we think that players was better off seeking out most other online slots with additional worthwhile incentive have. Inactive investment income made inside a business, simultaneously, try taxed in the a single predetermined fee of around fifty% in the Ontario, or close to the higher limited taxation speed. Couch potato tax prices are incredibly higher while the Canada Funds Company (CRA) doesn’t want us to provides an unfair tax virtue by paying the portfolios in to the firms. Register for CNBC’s on the internet direction How to Earn Passive Earnings On line to learn about common inactive earnings streams, ideas to begin and you can genuine-life success tales.

Your butt Potato slot is a great option for people looking to own a leading-top quality on the web casino slot games which have a decreased-risk foundation. Withholding income tax away from you during the business height first achieves the brand new aim of reducing one virtue you could have because of the broadening the investment capital in the business compared to. individually. What’s more, it creates equity for the reason that you are not double taxed thereon investment income when you take the cash from the firm as the a bonus. Considering this type of high cost, you can even ask yourself should you get the bucks out of your own holding organization and you will invest they in person, particularly when your own mediocre individual income tax speed is gloomier than just 50%. Instead, you could also think applying a secured item-allocation ETF services. These “all-in-one” ETFs are available in some other inventory/bond allocations for your risk choices, and therefore are global diversified.

The brand new Canadian stock-exchange did well total, because of time and you can merchandise visibility. All investment is actually negative inside 2022, with the exception of the real investment financing. I want to accept I requested the real difference inturn anywhere between these dos profiles becoming far higher. Amazingly, the couch Potato Collection achieved less CAGR compared to S&P 500, having roughly half of the brand new volatility, much reduced drawdowns, and much greater risk-adjusted get back (Sharpe).